The varieties of material your house or outbuildings are product of can significantly influence the amount you pay to insure them. Having something that's wood framed will cost you extra because it's more flammable. Building with cement and steel can be less more likely to burn, and therefore cost you less to insure.

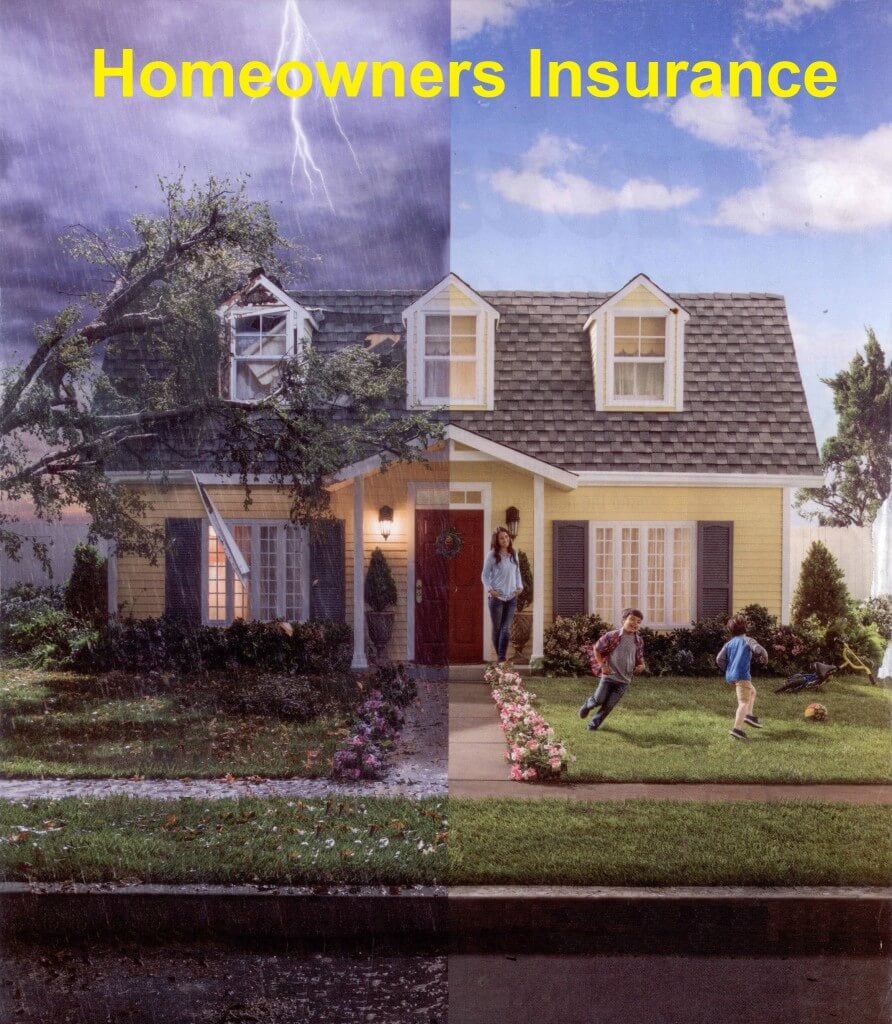

What would do you do if your own home was destroyed in a natural disaster and needs to be rebuilt? In case you bought your homeowner's insurance years ago, the cost of development and materials could have gone up. For that reason it's important to make sure you buy a Guaranteed Replacement Value Insurance premium which is able to assure that your own home might be rebuilt regardless of the associated fee.

Many homeowners are concerned with sustaining low annual insurance premiums. You'll be able to keep your premiums down by growing your deductible. A House Security System Will Permit You To Pay Less For Your House Insurance Policy corresponds to a decrease premium. Have sufficient cash so you may tackle smaller repairs you need to shell out cash for.

When you are looking into homeowners insurance coverage it can be a fairly dear factor. However if you do your analysis you could find ways to help lower your premium. One factor that some people do is to mix their insurance coverage policies. Most times while you mix homeowners insurance coverage along with your car insurance you can save a certain percentage.

To maintain your protection updated, be sure you review your homeowner's policy yearly. Let your insurer know of modifications in your house and property that may assist keep your premiums down. For example, if you have replaced a shake roof with something more fireproof, like composite shingles, you might get a premium reduction.

To keep away from an increase in your homeowner's insurance rate, it is best to keep away from submitting small claims. Useful Advice When Seeking An Insurance Policy For Your Private Home take even small claims into consideration when figuring if they need to keep you as a policyholder, and also you would possibly end up uninsured for the massive issues because you wanted to be be reimbursed for a relatively small quantity.

Pay off your mortgage! While you are, of course, planning to do this anyway, the sooner you complete it the better. The Keys To Personalizing Your Home Owner's Insurance Policy To Your Tastes believe that individuals who outright own their house are much more prone to take good care of it. Due to this, they may drop the rates for anyone who pays it off.

Install smoke detectors in your home. If you do not have already got fireplace alarms, get one or a number of. Check to see how many fire alarms are beneficial for a home of your measurement. It'll lower your home proprietor's insurance premium and help to maintain you safe within the occasion of a fireplace.

An annual assessment of your homeowners insurance policy could result in a considerable reducing of your premiums. In the occasion that you've got installed any kind of security or safety gadget such alarms or indoor sprinklers, a call to your insurance company and provisions of proof of those adjustments will end in substantial savings for you.

Homeowners insurance coverage can assist protect you financially in case an emergency occurs. Like the situation at the start of the article, your house might be damaged within the blink of an eye fixed. Apply Learn What You Must Learn About Home Owner's Insurance With These Tips in this text to make an knowledgeable decision about insurance for your own home and property.